Blog

Insights

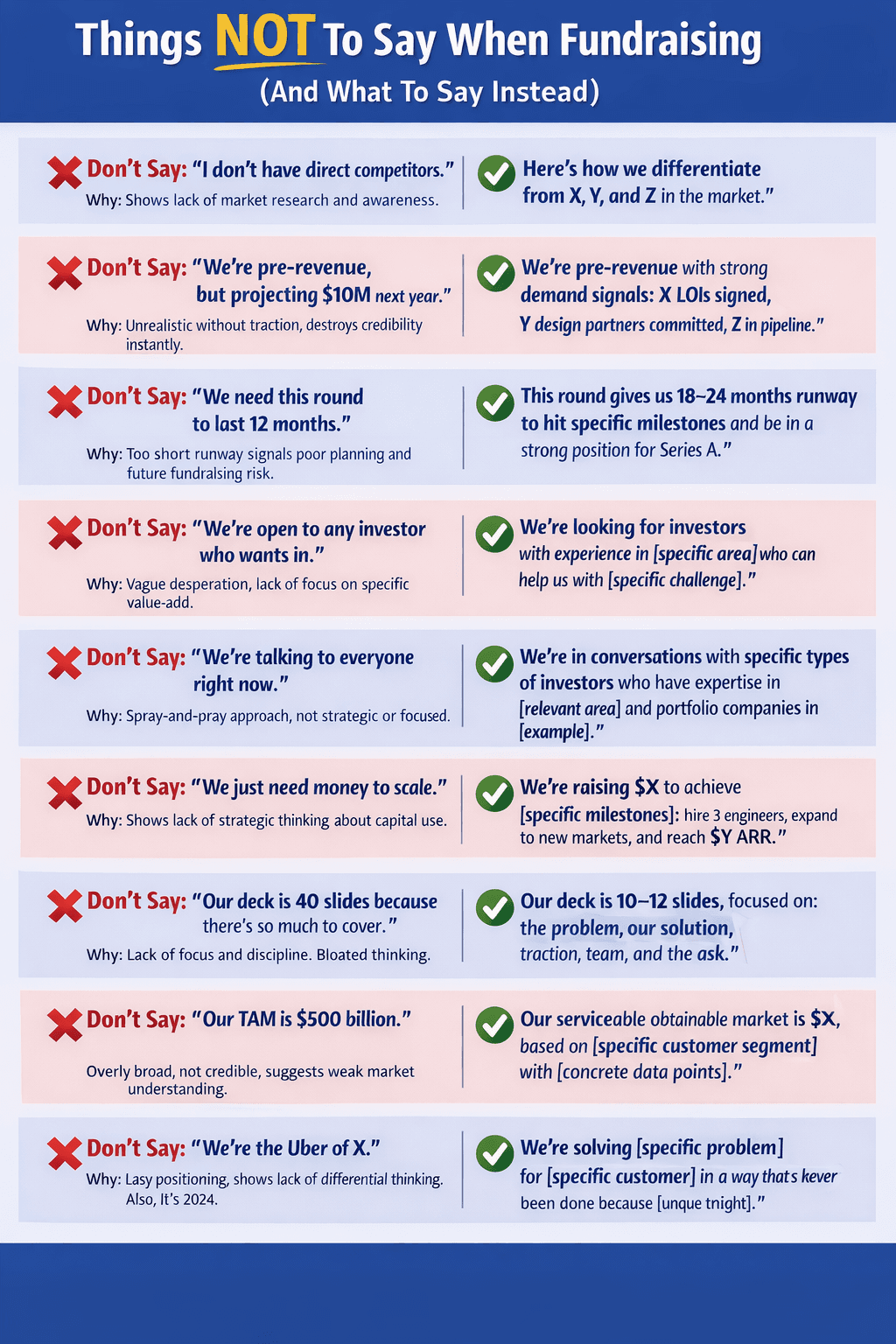

Things NOT to Say When Fundraising (And What to Say Instead)

Fundraising is as much about how you speak as what you build. This guide breaks down common things founders should avoid saying in investor meetings, why they raise red flags, and what to say instead to sound clear, credible, and prepared.

Ege Eksi

CMO

Feb 4, 2026

Fundraising conversations can be nerve-wracking, especially for first-time founders. It’s easy to slip up and use phrases that unintentionally raise red flags with potential investors. The truth is, how you communicate your vision and business is just as important as what you’re building. Investors are looking for founders who demonstrate clarity, awareness, and strategic thinking and certain phrases can signal the opposite.

In this post, we’ll go over some common things not to say during investor meetings, why they can hurt your pitch, and what to say instead to keep the conversation on track. These tips are founder-friendly and aimed at helping you speak the language that instills confidence. Here are ten fundraising faux pas to avoid, and how to rephrase them:

❌ Don’t Say: “I don’t have direct competitors.”

Why it’s a problem: Claiming you have no competition shows a lack of market research and awareness. Investors know that virtually every business has competitors (even if indirect or solving a similar problem in a different way). Saying “no competitors” suggests you haven’t done your homework or that you might be operating in a market with no demand. It can also imply arrogance — as if you believe you’re so unique that no one else could possibly solve this problem. This undermines your credibility because savvy investors will wonder if you truly understand your industry’s landscape.

✅ Say instead: “Here’s how we differentiate from X, Y, and Z in the market.” By acknowledging other players and clearly articulating how you stand out, you demonstrate that you know your competitive landscape. For example, you might continue with something like: “Competitor X serves a similar customer segment, but we differentiate ourselves by offering A and B, which they don’t. Competitor Y focuses on enterprise clients, whereas we’re targeting small businesses with a self-serve model.” This answer shows you’ve done the research and have a unique value proposition. It turns a potential weakness (competition) into an opportunity to highlight your strengths.❌ Don’t Say: “We’re pre-revenue, but projecting $10M next year.”

Why it’s a problem: Ambitious projections with no current revenue or traction come across as unrealistic and can destroy credibility instantly. If you haven’t earned a dollar yet, claiming you’ll hit eight figures in a year will make investors skeptical about your understanding of growth and sales cycles. It may seem like you’re just throwing out a big number to impress, without evidence to back it up. This over-promising signals a lack of grounded planning. Investors would rather see modest projections you can defend than huge numbers that seem to come out of thin air.

✅ Say instead: “We’re pre-revenue with strong demand signals: X LOIs signed, Y design partners committed, Z in pipeline.” Rather than projecting big revenue prematurely, point to concrete indicators of interest and traction that you do have. For instance: “We haven’t started generating revenue yet, but we’ve signed 10 Letters of Intent from potential customers, onboarded 3 design partners who are testing the product, and have 50 companies in our sales pipeline eager for our launch.” This tells investors that while you may not have revenue now, there’s verified demand and momentum behind your product. It’s a much more credible way to discuss future revenue potential, grounded in real current data.❌ Don’t Say: “We need this round to last 12 months.”

Why it’s a problem: Telling investors you only have enough funding goals for a 12-month runway raises concerns. Too short a runway signals poor planning – it suggests you haven’t budgeted for enough time to hit meaningful milestones. Investors know that fundraising itself can take months, and if you burn through the cash in just a year, you’ll be back pitching again almost immediately. This represents a future fundraising risk, as investors worry you might run out of money before achieving the progress needed for the next round. It might also indicate you’re underestimating challenges ahead.

✅ Say instead: “This round gives us 18–24 months of runway to hit specific milestones and be in a strong position for Series A.” Framing it this way shows that you’ve strategically planned the use of funds. For example: “With this raise, we’ll have 18 to 24 months of runway, which is sufficient to build out our product’s next version, grow to 100K active users, and reach $1M ARR. Hitting these milestones will put us in a strong position to raise a Series A when the time comes.” This response reassures investors that their capital will be used wisely to create real progress, and that you’re thinking ahead to the next stage (so they won’t have to worry about you running on fumes in a year).❌ Don’t Say: “We’re open to any investor who wants in.”

Why it’s a problem: While it might sound positive that you welcome all investors, this phrase actually comes off as vague and even desperate. It suggests you haven’t thought about who the right strategic partners are for your business. Investors often pride themselves on value-add beyond money – their network, domain expertise, mentorship. Saying you’re open to “anyone” indicates lack of focus on the specific value-add an investor could bring. It might make investors feel that you view all money as equal and don’t care who it comes from, or worse, that you’re struggling to attract interest and will take any deal.

✅ Say instead: “We’re looking for investors with experience in [specific area] who can help us with [specific challenge].” This tells investors you’re selective and strategic about your fundraising. For example: “We’re specifically looking for investors who have experience in SaaS enterprise sales because we plan to expand in that market and could use guidance on longer sales cycles. An ideal investor for us is someone who has scaled a startup from $1M to $10M ARR and can mentor us through that journey.” By saying this, you highlight that you value what comes beyond just the money – you’re seeking smart money from partners who can truly help the company grow. It also flatters potential investors by implying they have the expertise you need.❌ Don’t Say: “We’re talking to everyone right now.”

Why it’s a problem: Broadcasting that you’re “talking to everyone” when fundraising signals a spray-and-pray approach. It can make you seem not strategic or focused in your outreach. Top investors want to feel that you chose to approach them for a good reason – whether it’s their background, their portfolio, or alignment with your vision. If you imply that you’re indiscriminately pitching to any and all investors who will listen, it diminishes the sense of opportunity and urgency. It also hints that you may be getting turned down a lot, or that you haven’t identified what kind of investor is the right fit for your startup.

✅ Say instead: “We’re in conversations with specific types of investors who have expertise in [relevant area] and portfolio companies in [example].” This shows you have a targeted fundraising strategy. For example, you might say: “We’re currently in talks with a few seed funds and angels who specialize in healthcare tech and have backed companies in digital health. We believe their experience in navigating healthcare regulations and connections in the industry can really accelerate our growth.” This approach conveys that you’re choosy and intentional about who you pitch, focusing on investors who can genuinely add value and are likely to understand your business. It makes the investor you’re speaking with feel they’re one of those carefully selected people, rather than just another name on a long list.❌ Don’t Say: “We just need money to scale.”

Why it’s a problem: This phrase sounds simplistic and shows a lack of strategic thinking about how you’ll use capital. Every startup needs money to scale – stating it this way doesn’t set you apart or justify why an investor’s money will be well spent. It can give the impression that you see funding as a magic bullet for growth without a plan, or that you haven’t thought through the specific steps and investments required to scale up. Essentially, it’s too high-level and generic, when investors want to hear specifics and strategy.

✅ Say instead: “We’re raising $X to achieve [specific milestones]: hire 3 engineers, expand to new markets, and reach $Y ARR.” Here, you’re outlining exactly what the funds will be used for and what tangible results you aim to achieve. For example: “We’re raising $2 million which will primarily go towards scaling our team (we plan to hire 3 more engineers to accelerate product development), expanding into the European market (setting up a small local sales and support team there), and growing our recurring revenue from $200K to $1M annually. These milestones will position us for a strong Series A.” This level of detail shows you have a clear growth plan. It reassures investors that you’ll deploy their capital thoughtfully, linking dollars to outcomes. It’s much more compelling than simply saying you need money — you’re painting a picture of how that investment fuels progress.❌ Don’t Say: “Our deck is 40 slides because there’s so much to cover.”

Why it’s a problem: A overly long pitch deck screams lack of focus and discipline. If you feel the need to include 40 slides of information, investors worry that you haven’t distilled your story down to the essentials. In early fundraising meetings, attention spans are short; claiming “there’s so much to cover” and thus justifying a 40-slide behemoth suggests bloated thinking. It may indicate you’re too in the weeds or you think every detail is equally important (which isn’t the case). This can be a red flag because part of a founder’s job is to sift through information and highlight what truly matters.

✅ Say instead: “Our deck is 10–12 slides, focused on: the problem, our solution, traction, team, and the ask.” This demonstrates that you prioritize clarity and brevity. A concise deck means you’ve identified the key points that will resonate with investors. For instance, you might add: “We’ve kept our deck to 12 slides to respect your time and focus on the key areas: the problem we’re solving, our unique solution, the traction we’ve achieved so far, introductions to our core team, and the specifics of our fundraising ask.” By saying this, you convey confidence in your narrative — you’re not hiding behind a ton of slides. Investors will appreciate that you can communicate your vision succinctly (and they can always ask for more details in follow-up). It shows you understand that less is more when it comes to initial pitches.❌ Don’t Say: “Our TAM is $500 billion.”

Why it’s a problem: Boasting an enormous Total Addressable Market (TAM) like $500B is often overly broad and not credible, especially if it’s not directly tied to a specific customer segment or use case. Huge top-down market numbers can suggest a weak market understanding — investors have likely heard inflated TAM figures before, and it doesn’t impress them if it’s not clearly relevant to your business. In fact, it can backfire: they might think you don’t know your Serviceable market or beachhead market, and you’re just tossing out a big number hoping to wow them. It can also signal that you might be naive about where to start or how to realistically capture a slice of that giant pie.

✅ Say instead: “Our serviceable obtainable market is $X, based on [specific customer segment] with [concrete data points].” This approach is far more credible and precise. For example: “We estimate our Serviceable Obtainable Market at $500 million annually. This is based on targeting mid-sized U.S. manufacturers (about 5,000 companies) who spend on average $100K each on solutions in this space per year. We arrived at this number from industry reports and our own customer research.” By breaking it down, you show that you understand who your customers are and how much they’ll pay, which is much more meaningful than a vague multi-billion dollar guess. Investors are likely to trust a bottom-up analysis that highlights a realistic opportunity over an eye-popping number that feels disconnected from a go-to-market plan.❌ Don’t Say: “All our assumptions are conservative.”

Why it’s a problem: Nearly every founder is tempted to say their projections are conservative, hoping to preempt skepticism. But this claim has become a cliché — every founder says this, so it signals overconfidence, not rigor. Ironically, labeling assumptions “conservative” can make investors more doubtful, because truly conservative assumptions usually speak for themselves through evidence. It might also give the impression that you’re a bit too sure of your numbers, which can be dangerous if you haven’t thoroughly tested them. Investors would rather hear about the actual basis for your assumptions than just be told “don’t worry, these are conservative.”

✅ Say instead: “Here are our assumptions and the variables that could impact them. We’ve stress-tested for specific scenarios.” This response replaces buzzwords with transparent analysis. For example: “We assume a customer acquisition cost of $200 based on our pilot campaign results. However, if ad prices rise 20% or conversion rates dip, that cost could go up. We’ve modeled a scenario where CAC is $250 to see how it impacts our runway, and we would still break even on customers within 6 months in that case.” By walking investors through your assumptions and showing you’ve considered what could go wrong, you demonstrate rigor and preparedness. It’s far more convincing to discuss how you’ve challenged your own model than to simply insist you’ve been very conservative (which, in investors’ ears, often translates to overly optimistic).❌ Don’t Say: “We’re the Uber of X.”

Why it’s a problem: Comparing yourself to a famous company in a formulaic way — “the Uber of this,” “the Netflix of that” — is often seen as lazy positioning. It suggests a lack of differentiated thinking and originality. Early on, it became popular for startups to pitch themselves as the Uber of [industry] to quickly convey what they do, but by now this trope is overused. Investors in 2024 and beyond have heard it a thousand times; instead of clarifying your business, it can make them inwardly groan. It may also pigeonhole your idea inaccurately. Plus, Uber’s model doesn’t guarantee success in another domain (many “Uber of X” startups failed, highlighting that each market has unique challenges). Using this cliché can make it seem like you haven’t found a more precise way to describe your value.

✅ Say instead: “We’re solving [specific problem] for [specific customer] in a way that’s never been done because [unique insight].” This is a more compelling and original way to describe your startup. Rather than leaning on another company’s brand, you’re conveying your own unique insight and value proposition. For example: “Our company is addressing the lack of mental health support for college students (specific problem) by providing on-demand peer mentoring through a vetted network (how we solve it). Unlike existing counseling centers, we leverage students’ social connections with a matching algorithm we developed (unique insight/approach).” This sort of description is powerful because it highlights what makes you special. It shows you understand the problem deeply and have a novel solution, instead of just borrowing someone else’s fame. Investors will walk away with a clear idea of what you do and why it’s exciting, without the crutch of a trendy analogy.

Final Thoughts

For first-time founders, navigating the fundraising process is as much about communication as it is about metrics and product. Investors pay attention not just to what you’re pitching, but how you’re pitching it. By avoiding these problematic phrases and adopting the suggested alternatives, you’ll come across as more knowledgeable, credible, and founder-friendly — the kind of entrepreneur that investors want to bet on.

Remember, you want to instill confidence that you have a solid grasp of your business and a strategic plan for its growth. Small changes in wording can make a big difference. Instead of falling into common traps (outlandish projections, clichéd comparisons, or vague requests), focus on precision and clarity. Speak the language of strategy: acknowledge challenges, highlight realistic plans, and show that you’ve done your homework.

With the right phrasing, you signal to investors that you’re a thoughtful founder who understands their perspective. That can be the difference between a polite decline and an excited “Let’s continue this conversation.” Good luck, and happy fundraising!

Ege Eksi

CMO

Share